A Framework for Effective Risk Management

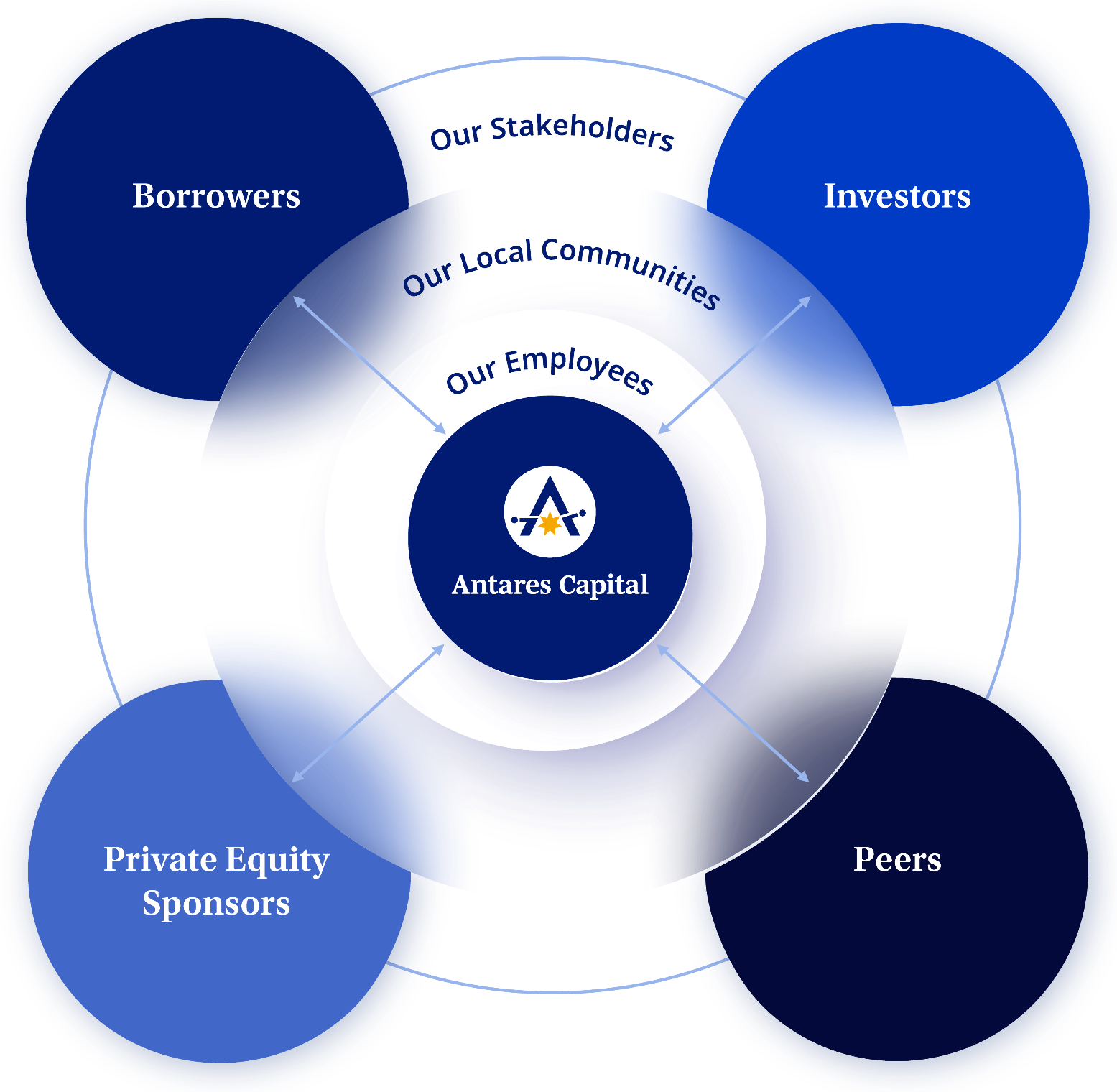

Responsible Investment is the umbrella for corporate responsibility within Antares. Our commitment to Responsible Investment reflects who we are, the role we play in the broader financial ecosystem, and how we can deliver value. These principles inform how we manage risk and assess investment opportunities. Further, effective engagement with our employees, local communities, and broader stakeholders helps drive our responsible Investment efforts.

As one element of our investment process for our Private Credit business, we apply the SASB Standards (Sustainability Accounting Standards Board) as a framework to review investments and weigh risk. This means looking closely at each investment with a lens on environment, social capital, human capital, business model and innovation, and leadership and governance. We also complete a relevant assessment of material environmental, social, and governance (“ESG”) factors, alongside other factors, as part of the investment process for our Liquid Credit platform.

As a Principles for Responsible Investment (“PRI”) signatory, we seek an active role in promoting Responsible Investment. A strong Responsible Investment proposition correlates with effective risk assessment and leverages insights across the portfolio.

Responsible Investment within Antares is characterized by collaboration with both our Private Credit and Liquid Credit peers, as well as other stakeholders within the asset management community. We factor in the needs of our private equity clients and what is most relevant for our borrowers. The breadth and scale of our portfolio of our private equity-backed companies provide a unique perspective and opportunity to engage on Responsible Investment topics with each stakeholder.

We are happy to send a copy of our policy to your inbox.